Economic turbulence across global markets has forced businesses to rethink how they evaluate their financial relationships with partners and clients. Traditional credit assessment methods no longer provide adequate protection against default risks and partnership failures. Organizations face mounting pressure to adopt sophisticated verification frameworks that deliver real-time insights into counterparty reliability and financial stability.

The Evolution of B2B Credit Verification

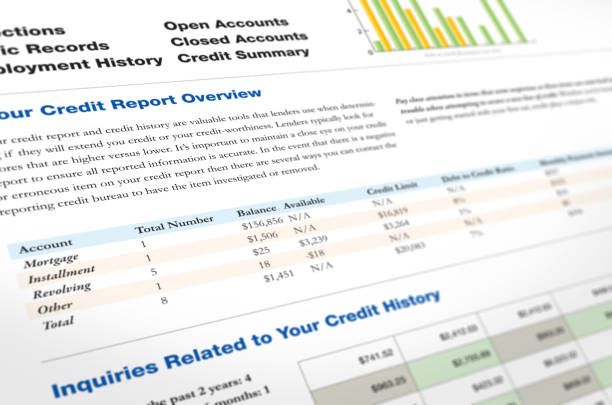

- Supplier Partnership Risk Assessment: The shift toward comprehensive company credit check protocols reflects growing concerns about supply chain vulnerabilities. Businesses cannot afford partnerships with financially unstable vendors. A single supplier failure can cascade through operations, causing production delays and revenue loss. Modern verification systems analyze payment histories, legal judgments, and financial statements to identify warning signs before commitments are made.

- Consumer-Facing Credit Technologies: Digital commerce demands faster approval processes and more accurate risk scoring. Consumer credit solutions now incorporate machine learning algorithms that process thousands of data points in seconds. These systems evaluate behavior patterns, transaction histories, and alternative data sources to generate creditworthiness scores. Banks and fintech platforms rely on these technologies to reduce fraud while expanding access to qualified applicants.

Real-Time Data Integration Changes Everything

- Continuous Monitoring Replaces Static Reports: Credit profiles change rapidly in volatile markets. What looked solid last quarter might be deteriorating now. Real-time monitoring systems track payment patterns, bankruptcy filings, and regulatory actions as they happen. This constant surveillance allows risk teams to spot problems early and adjust exposure limits before losses occur.

- Predictive Analytics Identify Future Risks: Historical data tells you where someone has been. Predictive models tell you where they’re heading. Advanced platforms analyze economic indicators, industry trends, and company-specific metrics to forecast potential defaults months in advance. Risk professionals use these projections to make proactive decisions about credit lines, payment terms, and relationship management strategies.

AI-Powered Risk Assessment

- Machine Learning Models Improve Accuracy: Algorithms trained on millions of credit decisions can identify patterns human analysts miss. These systems recognize subtle correlations between seemingly unrelated variables that signal financial distress. Perhaps a company’s payment history slows slightly while their accounts receivable days increase. Individually, these metrics might not trigger alerts. Together, they suggest cash flow problems that warrant investigation.

- Automated Decision Frameworks Increase Efficiency: Credit teams waste hours on manual reviews of low-risk applications. AI-powered workflows automatically approve straightforward cases while flagging complex situations for human judgment. This approach reduces processing times from days to minutes while freeing analysts to focus on nuanced risk scenarios that require expert evaluation and strategic thinking.

Alternative Data Sources Expand Risk Visibility

- Beyond Traditional Credit Bureaus: Financial statements and credit scores provide limited perspectives on creditworthiness. Alternative data sources reveal additional insights into business health and consumer behavior. Utility payment records, rental histories, and bank account activity fill gaps left by conventional reporting. These supplementary data points help lenders evaluate applicants with thin credit files or non-traditional financial profiles.

- Social and Digital Footprints Matter: Online presence and digital engagement patterns offer clues about business legitimacy and consumer stability. Companies with outdated websites, minimal social media activity, or inconsistent branding may signal operational problems. For consumers, digital behavior patterns can indicate lifestyle stability and financial responsibility that traditional metrics overlook.

Building Resilient Credit Frameworks

- Multi-Layered Verification Protocols: Single-source verification creates dangerous blind spots. Robust credit frameworks combine bureau reports, financial statement analysis, reference checks, and industry research to build comprehensive risk profiles. This multi-dimensional approach catches discrepancies and red flags that single-method assessments miss. Organizations that invest in thorough due diligence avoid costly mistakes from incomplete information.

- Adaptive Risk Policies: Static credit policies fail in dynamic markets. Businesses need flexible frameworks that adjust qualification criteria based on economic conditions, industry performance, and portfolio composition. When default rates rise in specific sectors, risk parameters should tighten automatically. When conditions improve, policies can relax to capture growth opportunities without compromising portfolio quality or organizational financial stability.

Strategic Advantages of Advanced Credit Management

Organizations that master modern credit risk management gain competitive advantages beyond loss prevention:

- Faster Growth: Efficient credit processes allow businesses to onboard customers and partners quickly while competitors struggle with outdated manual systems and delayed approval workflows.

- Better Relationships: Fair and transparent credit decisions build trust with customers, suppliers, and stakeholders, who appreciate consistent treatment based on objective data rather than subjective judgment.

- Market Intelligence: Credit data reveals industry trends, competitive positioning, and economic shifts to inform strategic planning beyond risk management applications and organizational decision-making.

Taking Action on Credit Risk: The gap between leaders and laggards in credit risk management widens daily. Organizations still relying on outdated verification methods expose themselves to preventable losses and missed opportunities. Businesses must evaluate their current credit assessment capabilities against modern standards. Investing in advanced verification systems, real-time monitoring tools, and predictive analytics platforms protects financial assets while enabling confident growth.

Start by auditing existing credit processes to identify vulnerabilities and technology gaps that compromise risk management effectiveness.

Featured Image Source: https://media.gettyimages.com/id/157681670/photo/credit-report.jpg?s=612×612&w=0&k=20&c=QMy9sH4XGf8hTBqMynD8TZyb6KCTtJWehpw7sobMvsY=